There is no personal income tax for individuals. They also do not pay taxes on dividends, wealth, inheritance, gifts and capital gains.

Regarding real estate purchase tax, there are two types of taxes: a transfer fee and a registration fee. The price depends on the Emirate and the cost of the property. One has to pay AED 2,000 for property worth less than AED 500,000, and AED 4,000 for that of more than AED 500,000. After buying, one is due to obtain an ownership certificate.

There is no property tax in the UAE. Owners pay only an annual fee for the maintenance of property. It ranges between USD 15 and USD 60 per m2.

Corporate tax is at 9% rate. It applies to companies earning more than AED 375,000 per year.

VAT is 5%. A company has to register as a VAT payer with the Federal Tax Authority and pay this tax in case the income is more than AED 375,000 per year.

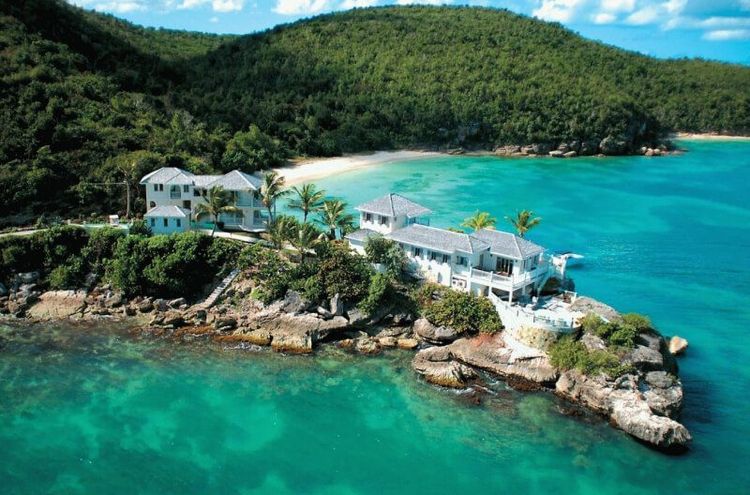

Don’t just guess. Get the best advice from one of our experts

Whether you need tax advice to prepare for a move abroad, to buy property or even retire, One World Migration can help. Consults upfront can help avoid costly mistakes and stress later.

Meet our expert